Daily SIP Calculator

Our Daily SIP Calculator is a user-friendly tool designed to help investors understand and plan their investments in mutual funds through daily contributions. With just a few inputs, see how your small daily investments could potentially grow over time using the power of compounding interest.

Invested Amount:

Estimated Returns:

Total Value:

What is Daily SIP?

A Daily Systematic Investment Plan (SIP) is an investment strategy that allows investors to contribute a fixed amount into a mutual fund scheme every day instead of larger sums monthly or quarterly. This approach is particularly suited to investors who wish to make investing a habitual part of their daily routine, aligning their investment contributions with their everyday spending habits.

From a strategic perspective, Daily SIPs might be more suited for aggressive investors who want to make the most of the compounding benefit in highly volatile investment environments. As markets fluctuate, investing daily can harness these fluctuations in a way that can be beneficial over the long term, especially in accumulating units when prices are low, thereby enhancing the potential returns when markets move positively.

This approach makes it easier to invest in a disciplined manner without stressing about market fluctuations, utilizing the benefits of rupee cost averaging and compounding. However, for those who can manage it, Daily SIP provides a disciplined investment approach that can help in building wealth gradually without the need to time the market.

Benefits of Daily SIP

Investing in a Daily Systematic Investment Plan (SIP) offers a strategic approach to wealth creation, allowing investors to make the most of their money with minimal daily contributions. Here are some of the key advantages:

1. Enhanced Compounding

By investing daily, you harness the power of compounding more effectively. Each day’s investment has more time to grow, potentially increasing your returns over the long term compared to less frequent investment intervals.

2. Reduced Market Volatility Impact

Daily SIPs help in mitigating the risk associated with volatile market movements. Since you invest regularly, you buy more units when prices are low and fewer when prices are high, which can lead to a lower average cost per unit over time.

3. Improved Affordability

With Daily SIPs, you can start investing with very small amounts. This makes mutual fund investments more accessible to a broader audience, allowing even those with modest means to build a portfolio gradually without financial strain.

4. Disciplined Saving Habit

Daily investments encourage a disciplined approach to saving and investing, which is crucial for long-term financial health. This regular investment habit can help instill financial discipline that extends to other areas of financial planning.

5. Flexibility and Convenience

Daily SIPs offer incredible flexibility. You can start, stop, or modify your investment amount based on your current financial situation, without any penalty or hassle.

6. Leveraging Technology

With advancements in fintech, managing Daily SIPs has become extremely convenient. Automated transactions reduce the need for manual intervention and allow you to maintain a consistent investment schedule effortlessly.

How Are Daily SIP Investment Returns Calculated?

Calculating returns on a Daily SIP requires understanding the principles of compound interest and its application over very short intervals, such as days. Here’s a step-by-step explanation of how these returns are typically calculated:

Compound Interest Formula

The fundamental formula used to calculate the future value of a SIP investment is:

Where:

FV is the future value of the SIP investment.

P is the daily investment amount.

r is the annual rate of return (expressed as a decimal).

n is the number of compounding periods per year.

t is the total investment duration in years.

Example:

If you invest ₹100 daily in a fund that offers an annual return of 10%, and you continue this investment for 5 years, here’s how you might approximate the future value:

The future value is approximately ₹2,36,806.92. This result showcases the significant growth potential through the power of daily compounding in a Systematic Investment Plan (SIP).

How to Use Daily SIP Calculator

Using our Daily SIP Calculator is simple and straightforward. Here’s a step-by-step guide to help you maximize your investment planning:

Step 1. Input Your Daily Investment: Start by entering the amount you wish to invest each day. This could be as low as ₹100, making it accessible even if you’re just starting out with mutual fund investments.

Step 2. Set the Expected Return Rate: Input the annual return rate you anticipate from your investments. This rate should reflect realistic market returns based on the type of mutual funds you choose. If unsure, a typical range for equity funds can be between 10% to 15%.

Step 3. Choose the Investment Duration: Decide how long you plan to keep your SIP running. The duration is typically set in years and can significantly impact the compounding effect of your returns. Longer durations generally lead to more substantial growth due to compounding.

Step 4. Review the Results: Once you submit your inputs, the calculator will display three key results:

- Total Invested Amount: The cumulative sum of your daily investments over the entire duration.

- Estimated Returns: The projected earnings on your investments at the end of the period, calculated using the compound interest formula.

- Total Accumulated Value: The sum total of your invested amount and the estimated returns, giving you a complete picture of what your investment could grow to at the end of the investment period.

Step 5. Visualize with the Doughnut Chart: Alongside numerical data, our calculator provides a colorful doughnut chart that visually breaks down your total investment versus the returns. This visual representation helps you quickly grasp how your money is working for you.

Step 6. Experiment with Different Scenarios: Feel free to adjust the variables — try different amounts, return rates, and durations to see how changing one factor can impact your overall investment growth. This feature is particularly useful for financial planning and understanding the power of regular investments.

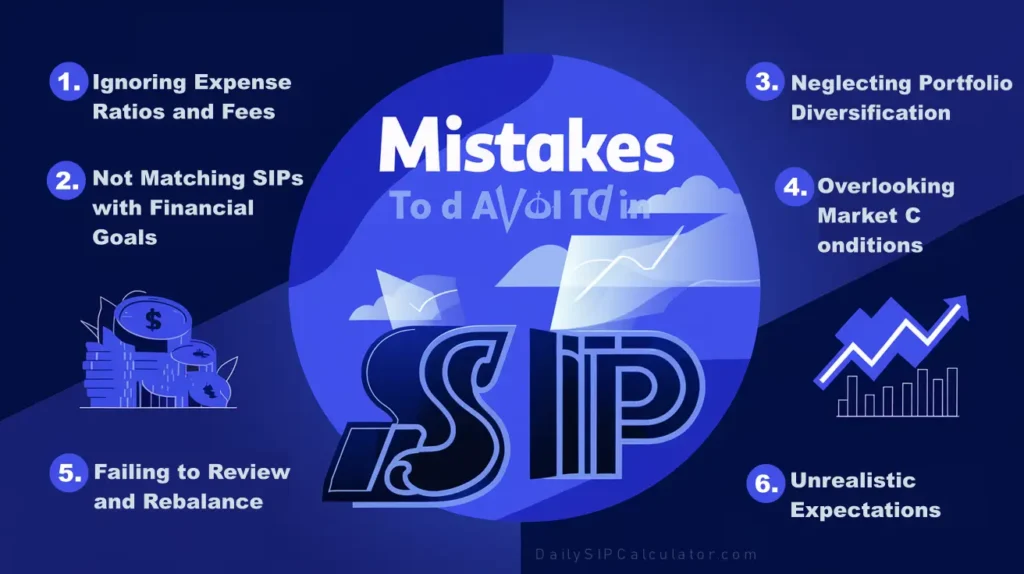

Mistakes to Avoid in Daily SIP

Investing through a Daily Systematic Investment Plan (SIP) can be a smart way to build wealth over time. However, like any investment strategy, certain pitfalls can undermine its effectiveness. Here are key mistakes to avoid to ensure your daily SIP works optimally for your financial goals:

1. Ignoring Expense Ratios and Fees

Each mutual fund has associated costs, such as expense ratios and administrative fees. While these fees might seem small, they can significantly impact your returns over time, especially in a daily SIP where small amounts are invested regularly. Always choose funds with reasonable fees to maximize your net returns.

2. Not Matching SIPs with Financial Goals

Investors often start SIPs without a clear understanding of their financial objectives. Whether it’s saving for retirement, buying a home, or funding education, ensure that the risk profile and expected returns of the selected fund align with your goals and investment horizon.

3. Neglecting Portfolio Diversification

Relying too much on a single mutual fund or asset class can expose you to unnecessary risk. Diversifying across different types of funds, such as equity, debt, and hybrid funds, can help mitigate risks and stabilize returns, particularly important when investing daily.

4. Overlooking Market Conditions

While daily SIPs reduce the risk of timing the market, staying informed about market trends and economic factors is crucial. In periods of high volatility, consider adjusting your investment strategy or consulting with a financial advisor to navigate turbulent markets effectively.

5. Failing to Review and Rebalance

A common mistake is to “set and forget” a SIP. Regular reviews—at least annually—are essential to ensure that the investment continues to meet your expectations and market conditions. Rebalancing the portfolio to maintain the original asset allocation can help in managing risk and optimizing returns.

6. Unrealistic Expectations

Daily SIPs facilitate steady growth, but they are not a quick wealth-building strategy. Setting realistic expectations about returns, based on historical performance and future market outlook, is crucial. Patience and long-term commitment are key to realizing the benefits of compounding in daily SIPs.

By steering clear of these mistakes, you can enhance the effectiveness of your daily SIP investments, ensuring that they contribute positively towards achieving your financial aspirations.

Daily SIP VS Monthly SIP

Investors often choose between Daily and Monthly SIPs based on their income schedules and investment goals. Daily SIPs involve investing smaller amounts every day, which can help in mitigating market volatility more effectively by averaging the purchase price of mutual fund units throughout the month.

This method suits those who wish to make investing a daily habit without waiting for a salary credit. On the other hand, Monthly SIPs align better with monthly income cycles, where investors commit a larger sum once a month. This approach is less frequent but fits seamlessly into most budgeting routines, making it ideal for those who plan their investments around their monthly financial commitments.

FAQs

What is the minimum daily SIP amount?

The minimum daily SIP amount can vary by fund but typically starts as low as ₹100.

Is SIP 100% safe?

No investment is 100% safe. SIPs help mitigate risks by spreading the investment over time but are subject to market risks.

Which SIP is best for daily investment?

Choosing the best SIP depends on your financial goals, risk tolerance, and investment horizon. Equity funds are suitable for long-term growth, while debt funds may be preferred for stability.

Can I do daily SIP in mutual funds?

Yes, many mutual funds offer the option to make daily investments through SIPs, allowing investors to benefit from the potential for higher compounding returns.